Crypto crashes could wipe out up to $10 billion in leveraged positions, says Bybit CEO

Key Takeaways

Bybit CEO estimates crypto liquidations could reach up to $10 billion.

API limitations can cause discrepancies in reported liquidation data.

Share this article

Bybit CEO Ben Zhou estimates total crypto liquidations across exchanges could reach between $8 billion and $10 billion. According to Zhou, his platform alone recorded $2.1 billion in liquidations in the last 24 hours, despite Coinglass data showing only $333 million.

In other words, real crypto liquidations across markets could be considerably higher than publicly reported figures. Bybit CEO explained that API limitations on data feeds were the reason behind the discrepancy between reported and actual liquidation figures.

“We have [API] limitations on how much feeds are pushed out per second. From my observation, other exchanges also practice the same to limit liquidation data,” Zhou said.

In response to these reporting gaps, Zhou added that Bybit would begin publishing comprehensive liquidation data.

“Moving forward, Bybit will start to PUSH all liquidation data. We believe in transparency,” he said.

The crypto market reacted sharply, and brutally following Trump’s tariff announcement on Saturday.

Bitcoin fell below $92,000 for the first time since January, while Ethereum and other altcoins recorded double-digit losses. Coinglass data showed over $2 billion in liquidations across crypto derivatives exchanges during the sell-off.

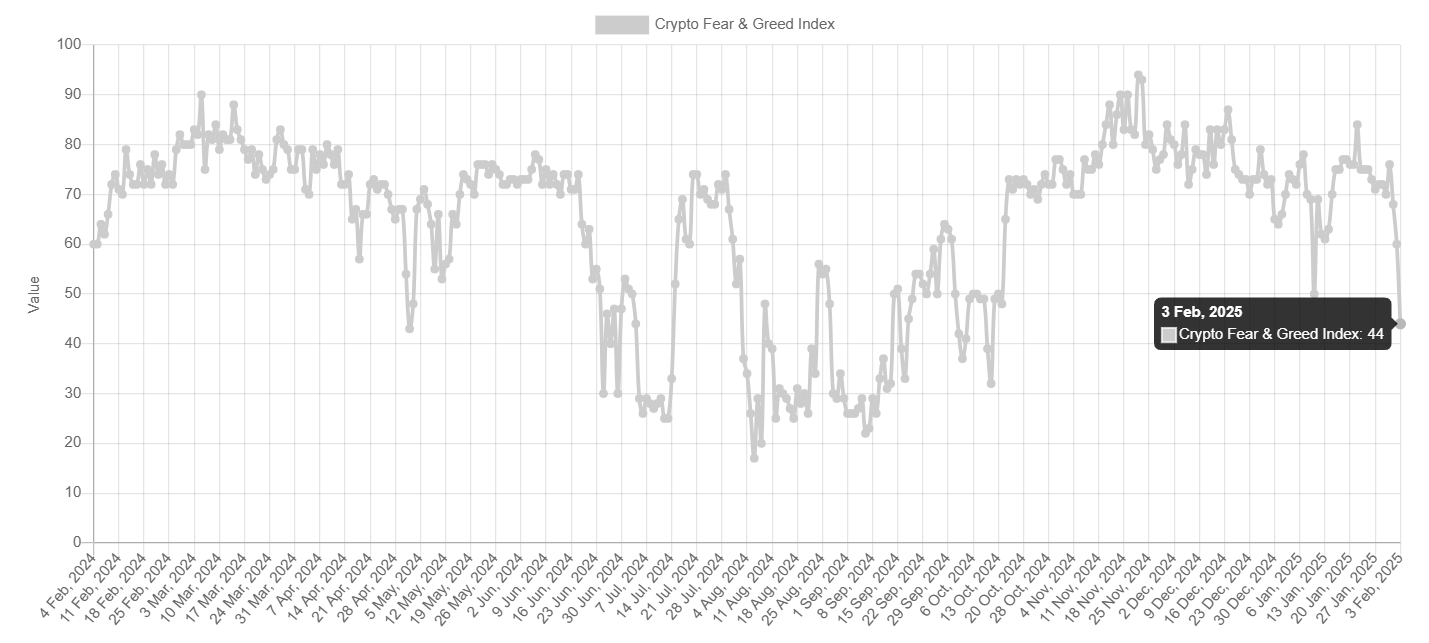

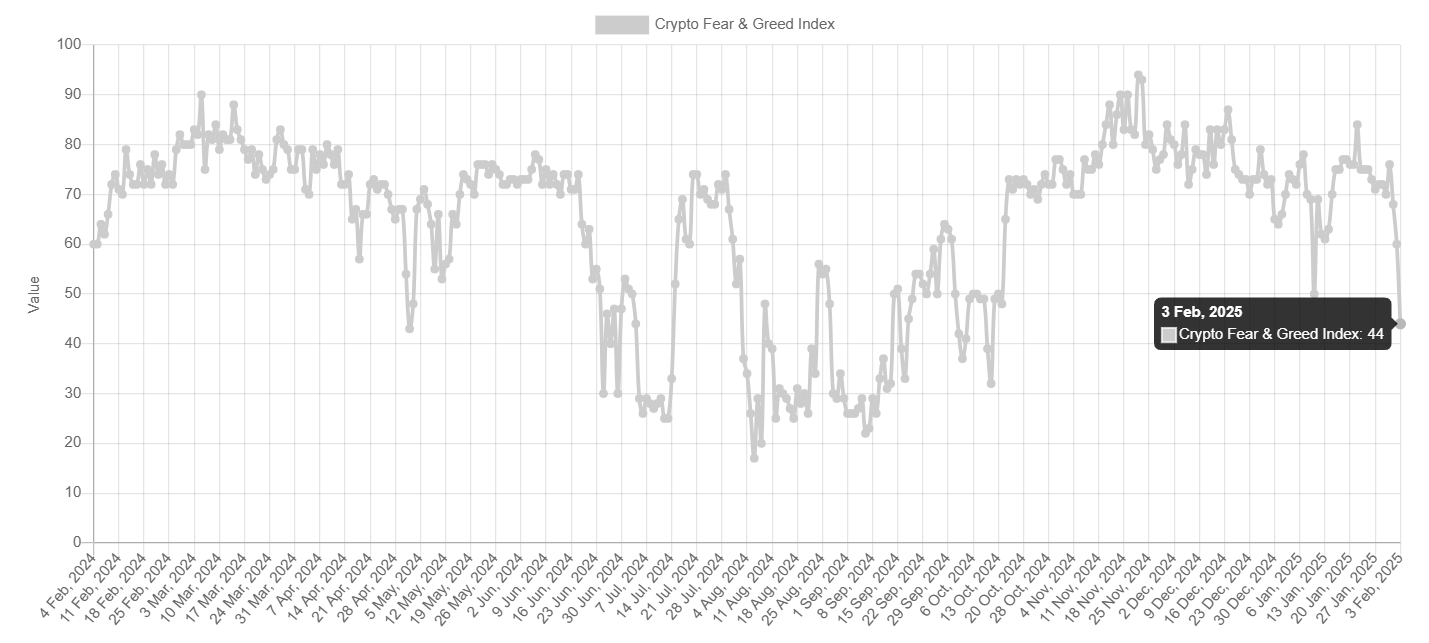

The Crypto Fear and Greed Index dropped from 60 to 44, entering the “fear” zone at its lowest level since October 11.

The President said he would implement a 25% tariff on imports from Canada and Mexico, as well as a 10% tariff on Chinese goods. The measures are scheduled to take effect tomorrow as part of efforts to address border security and combat drug trafficking.

Economists warn that Trump’s new tariffs could worsen inflation, which is still stubbornly below the Fed’s 2% target.

Last week, the central bank decided to leave interest rates unchanged at 4.25% and 4.50%. Fed Chair Jerome Powell indicated that future rate adjustments would be contingent on incoming data, labor market trends, and inflation developments.

Powell had previously indicated that the central bank would assess the impact of Trump’s economic policies to make future rate decisions. Jacob Channel, senior economist at LendingTree, told CBS News that potential changes in economic policies under Trump “might cause a resurgence in inflation or otherwise throw the economy off balance.”

Jeff Park from Bitwise Asset Management, however, suggests Trump’s new tariffs could increase Bitcoin demand as an inflation hedge.

Share this article