MicroStrategy to Sell $2 Billion in Stock to Buy More Bitcoin

Strategy (formerly MicroStrategy) is conducting a private offering of convertible senior notes. The firm will offer $2 billion of these assets and use the proceeds to buy more Bitcoin.

Saylor announced that his firm had not bought any Bitcoin in the last week, further interrupting his purchasing trend. Still, other than this detail, everything else seems to fit within his standard acquisition playbook.

Strategy Keeps Buying Bitcoin

Since MicroStrategy (recently rebranded to Strategy) began acquiring Bitcoin, it’s become one of the world’s largest BTC holders. Earlier this month, the firm broke its 12-week streak of consecutive purchases, quickly resuming it shortly afterward.

Today, Michael Saylor acknowledged that the company paused its purchases again, but not for long:

“Last week, Strategy did not sell any shares of class A common stock under its at-the-market equity offering program, and did not purchase any bitcoin. As of 2/17/2025, we hold 478,740 BTC acquired for ~$31.1 billion at ~$65,033 per bitcoin,” Saylor claimed.

Specifically, a few hours after Saylor made this first post, he followed it up with another announcement. The company is planning to privately offer $2 billion worth of convertible senior notes.

These stock offerings, of course, will help Strategy fund more Bitcoin purchases. This is an established technique for the company, making a similar offering last month.

Strategy has employed a few different tactics to continue these major Bitcoin acquisitions. It sold enough stock that BlackRock now owns 5% of the company, and its Strike Preferred Stock (STRK) has been a strong performer. The company’s formidable BTC stockpile has significantly appreciated in value, but the company is strictly holding these assets.

The price of Bitcoin has been somewhat wobbly over the past few weeks, which may present an opportunity for Strategy. After striking ups and downs, its price is consolidating just under the $100,000 mark. This isn’t much of a price decline in the grand scheme, but it will still help Strategy get more assets for the same investment.

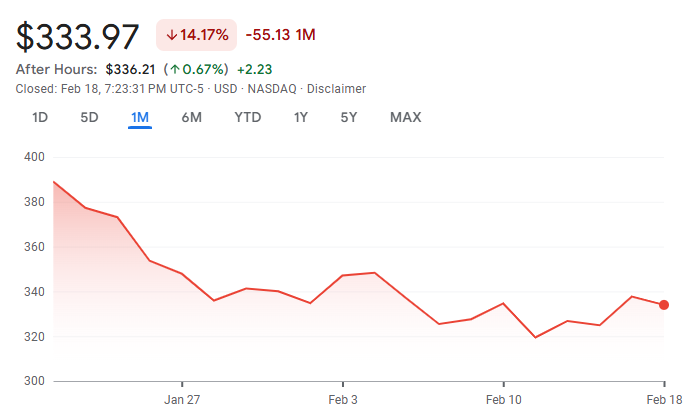

Meanwhile, MSTR’s stock price has also underperformed recently. It remains down by nearly 15% in the past month.

Ultimately, this whole operation seems pretty by the book. Strategy has clearly telegraphed its intentions to buy more Bitcoin with this stock sale, just like several other recent offerings.

Although there have been rumors that the firm may face difficulties fulfilling this strategy, they haven’t surfaced yet. For now, Saylor seems content with the same outlook – maximalist bullishness.

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.