Berachain Price Drops 30%—More Losses Ahead?

Berachain (BERA) has suffered a steep decline over the past week, shedding 30% of its value as bearish sentiment plagues the general market.

In the past 24 hours alone, the token has slid another 6%, deepening concerns of further downside. With growing bearish bias against the altcoin, this might be the case in the near term.

BERA Faces Mounting Downside Risk

Berachain’s sharp decline has triggered a surge in short positions across its futures market. This rise in demand for shorts is evident in its funding rate, which has been negative since the token’s launch on February 6. At press time, this is at -0.11%.

The funding rate is a periodic fee exchanged between long and short traders in perpetual futures contracts to keep prices aligned with the spot market.

A negative funding rate means that short traders are paying long traders, indicating a stronger demand for short positions.

As with BERA, if an asset experiences an extended period of negative funding rates, it suggests sustained bearish sentiment. It indicates that the token’s traders consistently bet on further price declines. This prolonged negativity could increase BERA’s price volatility and extend its price fall.

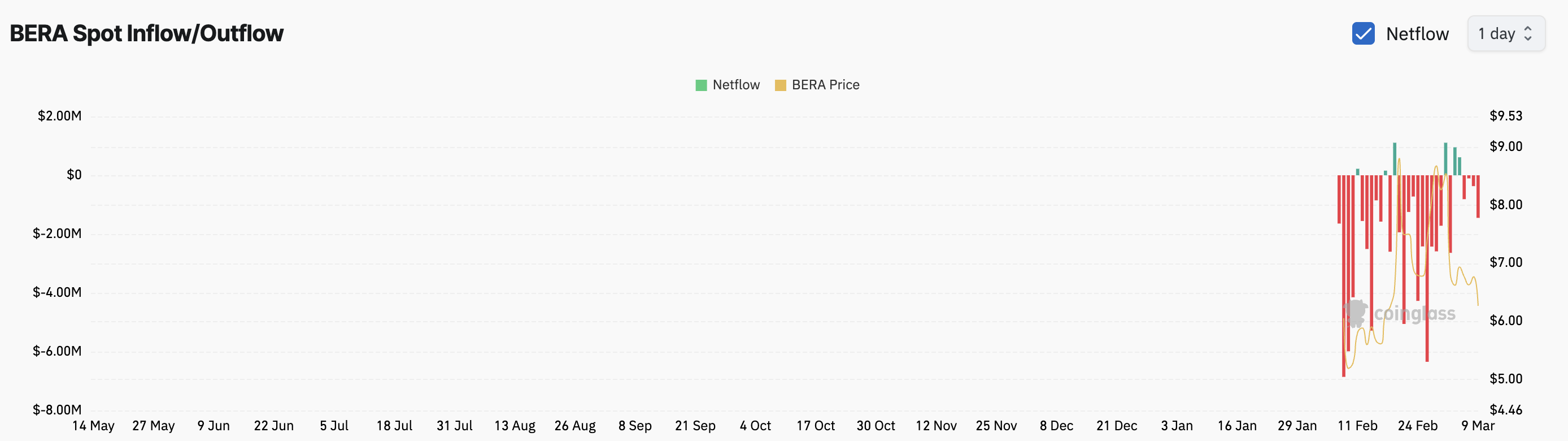

In addition, BERA has noted significant fund outflows from its spot markets over the past few days. Per Coinglass, the altcoin has noted almost $2 million in spot market outflows today alone.

When an asset experiences spot outflows like this, it signals a surge in selling pressure. It indicates a bearish trend as investors reduce exposure or take profits, potentially leading to further price declines.

BERA at a Crossroads—Break Below $6.07 or Rally Toward $7.36?

Berachain trades at $6.14 at press time, resting slightly above support at $6.07. If the bearish bias against the altcoin strengthens, its price could break below this support floor, causing the token to trade at a low of $5.35.

If the bulls fail to defend this level, BERA could slip to its all-time low of $4.74.

On the other hand, if market sentiment improves and BERA’s demand soars, its price could rally to $7.36.

Disclaimer

In line with the Trust Project guidelines, this price analysis article is for informational purposes only and should not be considered financial or investment advice. BeInCrypto is committed to accurate, unbiased reporting, but market conditions are subject to change without notice. Always conduct your own research and consult with a professional before making any financial decisions. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.