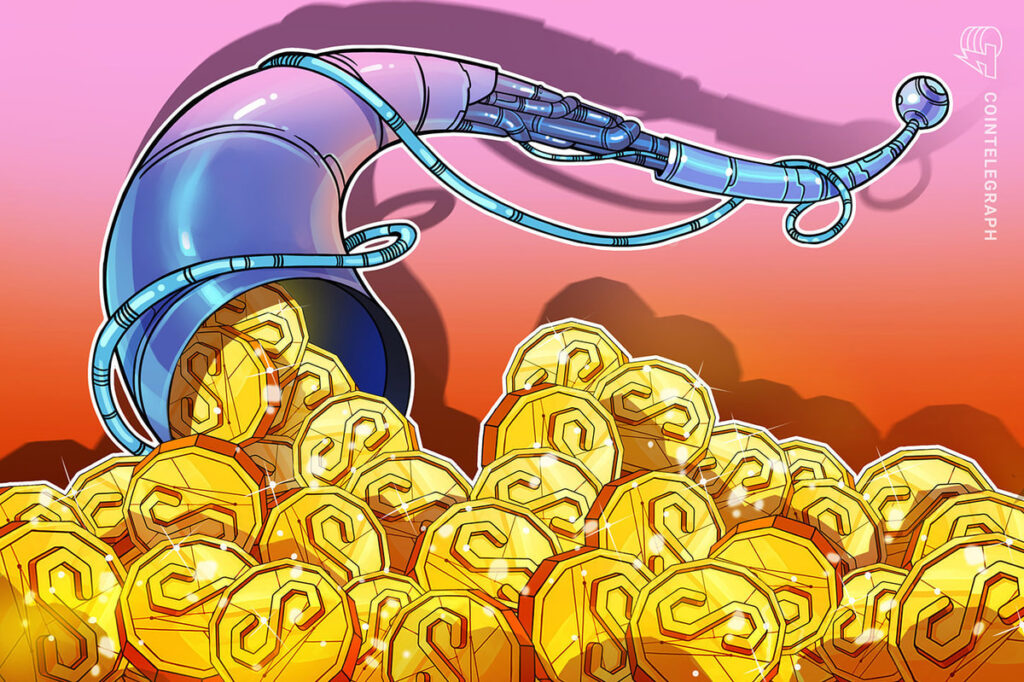

$1T stablecoin supply could drive next crypto rally — CoinFund’s Pakman

The global stablecoin supply could surge to $1 trillion by the end of 2025, potentially becoming a key catalyst for broader cryptocurrency market growth, according to David Pakman, managing partner at crypto-native investment firm CoinFund.

“We’re in a stablecoin adoption upswell that’s likely to increase dramatically this year,” Pakman said during Cointelegraph’s Chainreaction live show on X on March 27. “We could go from $225 billion stablecoins to $1 trillion just this calendar year.”

He noted that such growth, while modest compared to global financial markets, would represent a “meaningfully significant” shift for blockchain-based finance.

Pakman also suggested that the rise in capital flowing onchain, combined with growing interest in exchange-traded funds (ETFs), could further support decentralized finance (DeFi) activity:

“If we have a moment this year where ETFs are permitted to provide staking rewards or yield to holders, that unlocks really meaningful uplift in DeFi activity, broadly defined.”

https://t.co/v9lOnk00QY

— Cointelegraph (@Cointelegraph) March 27, 2025

Related: BlackRock Bitcoin ETP ‘key’ for EU adoption despite low inflow expectations

The aggregate stablecoin supply stood at an all-time high of above $208 billion across the five largest stablecoins on March 28, according to Glassnode data.

Stablecoins, aggregate supplies. Source: Glassnode

“This is the major catalyst that’s been missing for over a decade: a major movement of people’s wealth onchain that brings everyone else on,” added Pakman.

The growing stablecoin supply recently surpassed $219 billion and continues to rise, suggesting that the market is “likely still mid-cycle” as opposed to the top of the bull run, according to IntoTheBlock analysts.

Related: Most EU banks fail to meet rising crypto investor demand — Survey

Stablecoin payment adoption on the rise

Stablecoins use for daily payments is on the rise, illustrating the efficacy of blockchain-based transactions.

“We’re up over 22x in stablecoin volume since 2021,” Pakman said, adding:

“We’ve seen a significant decrease in the size of each stablecoin transaction, which points to the fact that they are being used more as payments and less for large transfers.”

BTC-to-stablecoin ratio. Source: Ki Young Ju

That aligns with recent comments from CryptoQuant founder and CEO Ki Young Ju, who said stablecoins are increasingly being used for remittance payments and as a store of value. However, Ju said stablecoin supply won’t pump Bitcoin’s (BTC) price without additional catalysts.

Magazine: Bitcoin $500K prediction, spot Ether ETF ‘staking issue’— Thomas Fahrer, X Hall of Flame