Trump urges Fed to lower rates, but strong jobs data makes a cut in June less likely

Key Takeaways

President Trump is urging the Federal Reserve to cut interest rates despite strong employment data.

The Federal Reserve is unlikely to lower rates in June due to stable hiring activity.

Share this article

President Trump on Friday renewed pressure on the Fed to cut interest rates, but the robust April employment data that followed has lowered the odds of a June rate cut, according to Nick Timiraos, often referred to as the “Fed’s mouthpiece” at the Wall Street Journal.

The next Fed policy meeting is scheduled for May 6–7, 2025. Economists broadly expect the central bank to keep the federal funds rate unchanged in its current range of 4.25% to 4.5% during this meeting.

This means that attention is shifting to the following meeting on June 18. According to Timiraos, only one more jobs report will be released before that meeting, leaving limited time for economic conditions to deteriorate enough to warrant a rate cut.

The Fed relies heavily on monthly labor data to gauge whether the economy is weakening. Since April’s report was stronger than expected, it reduces the urgency of any immediate monetary policy easing.

According to the US Bureau of Labor Statistics, non-farm payrolls rose by 177,000 in April, beating market expectations. The unemployment rate held steady at 4.2%, continuing a narrow range that’s been in place since May 2024.

Job gains were most notable in sectors such as health care, transportation and warehousing, financial activities, and social assistance, while federal government employment declined.

Fed officials have emphasized that a decision to lower interest rates would likely require clear evidence of rising unemployment or weakening labor demand.

So far, the new data show few signs of declining hiring activity, giving the central bank justification to maintain its wait-and-see stance, despite uncertainties, including the potential economic effects of recently reimposed tariffs.

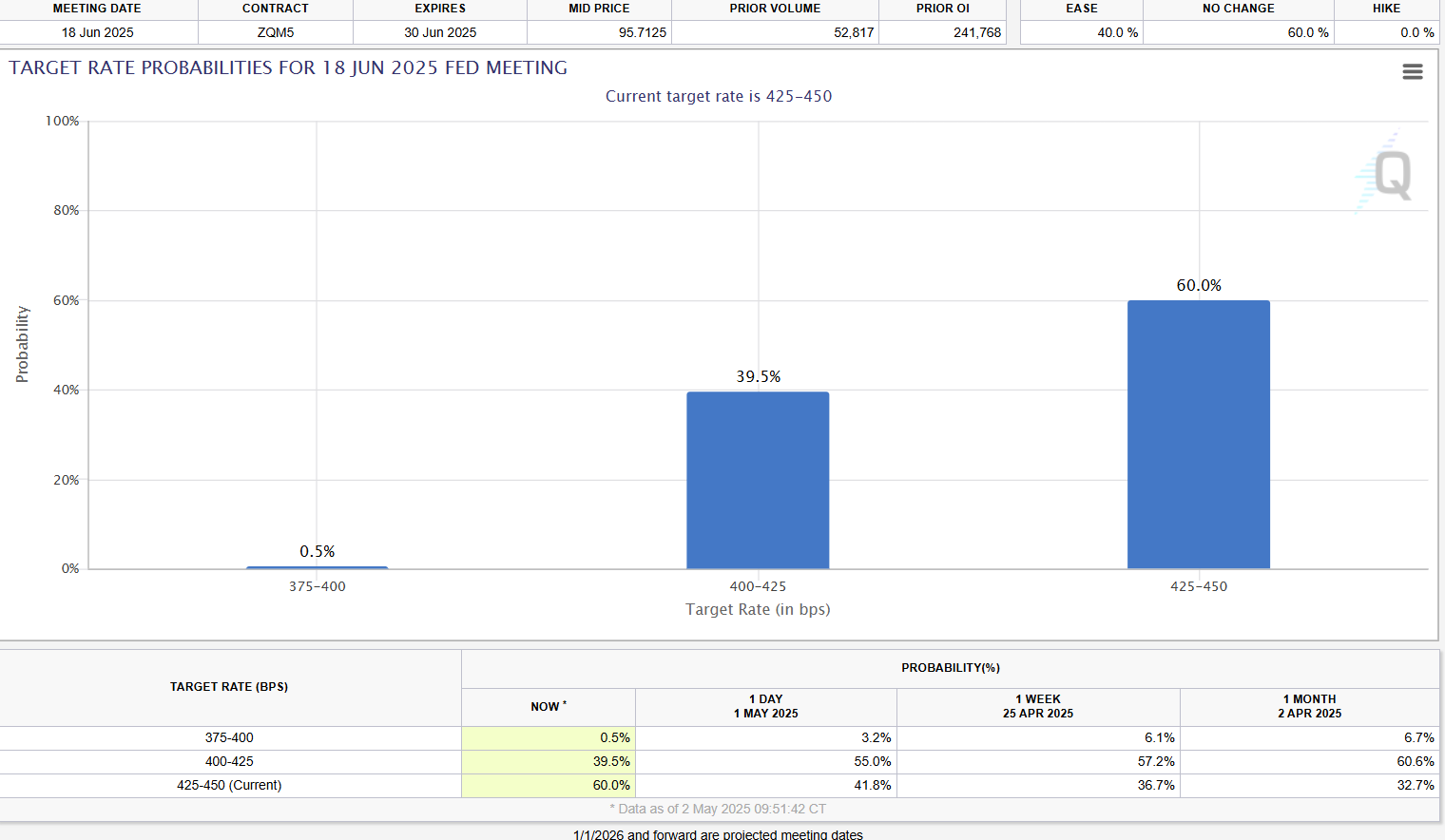

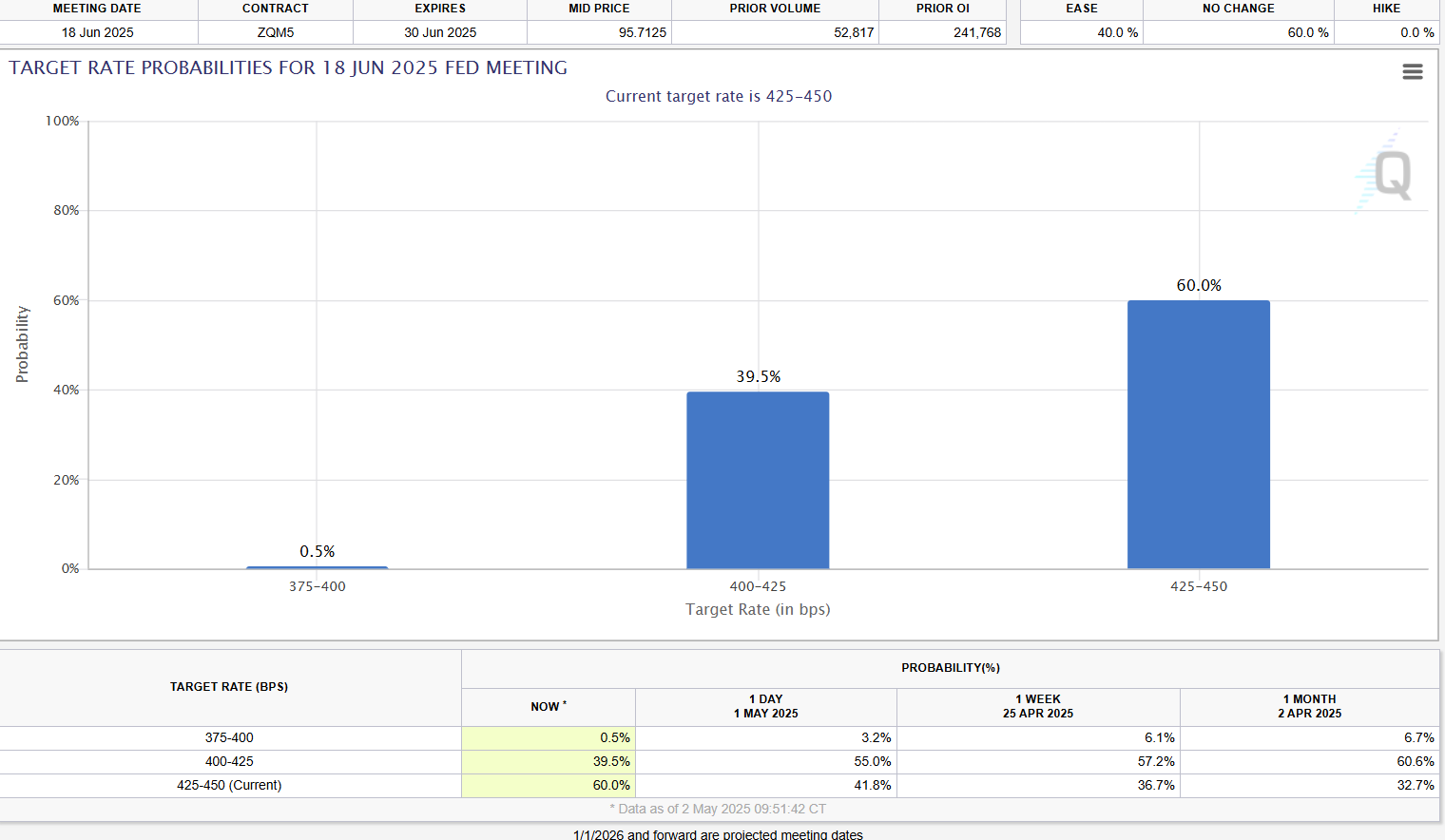

Following the release of the April jobs report, market expectations for a June rate cut fell from roughly 58% to 40%, according to day-to-day shifts tracked by the CME FedWatch tool. Investors now see about a 60% chance that the Fed will hold rates steady in June.

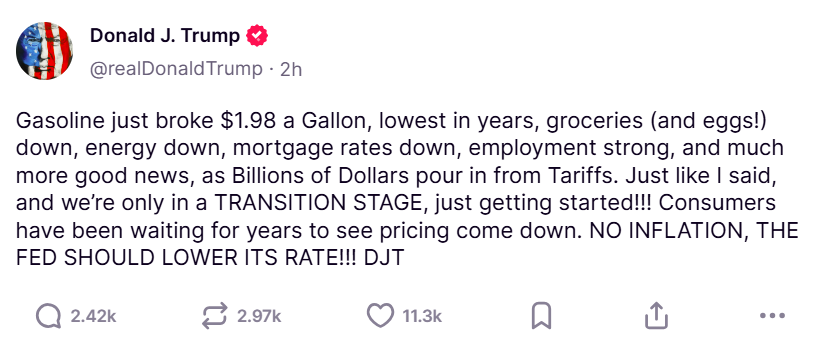

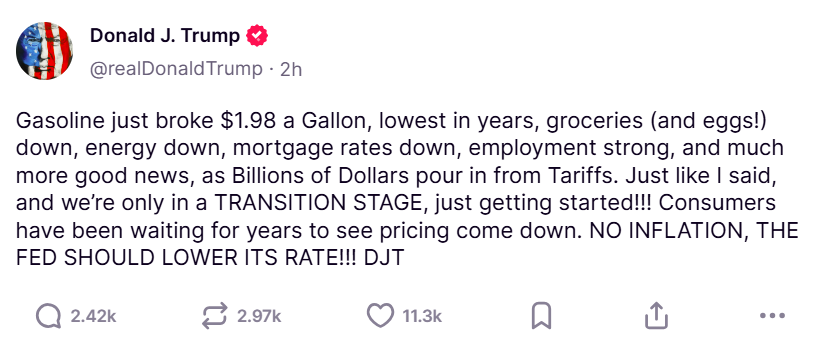

In his statement urging the Fed to act, Trump claimed there is “no inflation,” arguing that consumers are finally experiencing long-awaited price relief.

He pointed to declining gasoline prices, lower grocery and energy costs, falling mortgage rates, and strong employment figures as signs that the economy is stabilizing.

With inflation no longer a threat, Trump insisted, the Fed should act swiftly to cut interest rates to support continued economic growth.

Share this article