What Does This Mean for Altcoins?

Bitcoin’s (BTC) market dominance has surged to 64%, reaching its highest level in over four years.

However, experts remain divided on what this means for the future. Some predict an impending altcoin season, and others caution that Bitcoin’s dominance could continue to suppress altcoins.

What Does Bitcoin’s Rising Dominance Mean?

For context, Bitcoin dominance (BTC.D) refers to the percentage of the total cryptocurrency market capitalization that BTC holds. It is a key indicator of Bitcoin’s market strength relative to other cryptocurrencies. A rising dominance suggests that Bitcoin is outperforming altcoins, while a decrease may signal growing interest or investment in other digital assets.

The metric has been steadily increasing since late 2022. As of the latest data, it surged to 64%, marking highs last seen in early 2021.

Notably, Benjamin Cowen, founder of Into The Cryptoverse, highlighted that the number is much higher when excluding stablecoins.

“Excluding stable coins, Bitcoin dominance is now at 69%,” Cowen revealed.

The rise in Bitcoin dominance has sparked debate among analysts about its implications for altcoins. Cowen believes there will be a correction or downward movement in altcoins before any substantial gains can be expected in the market. This implies that the altcoin season may not be imminent yet.

“I think ALT/ BTC pairs need to go down before they can go up,” he stated.

Nordin, founder of Nour Group, also expressed caution. He stressed that Bitcoin dominance is nearing the levels seen during the peak of the 2020 bear market.

“This isn’t just a BTC move. Its capital rotating out of alts,” he noted.

Moreover, Nordin warned that a break above 66% could intensify selling pressure on altcoins. This, in turn, could delay the altcoin season.

“Bitcoin dominance back to 64%. No Alt seasons in 2024 or 2025,” analyst, Alessandro Ottaviani, predicted.

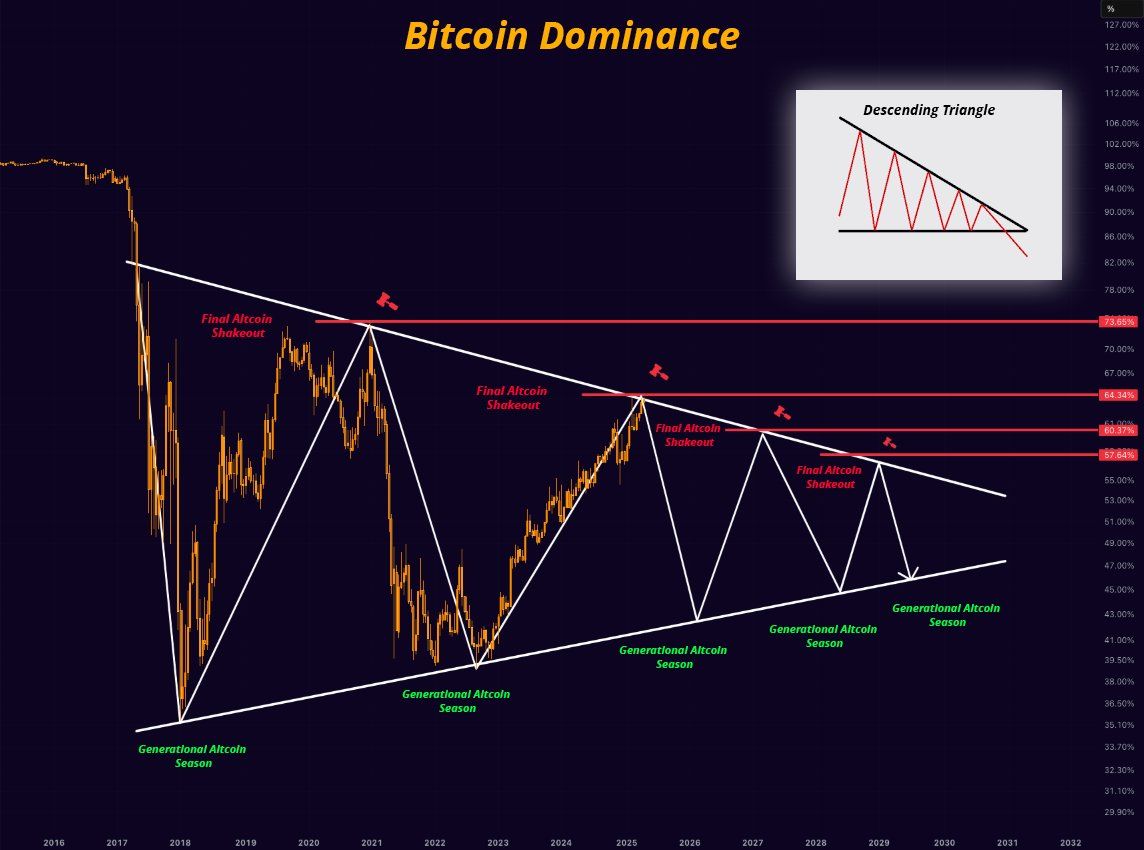

On the other hand, analyst Mister Crypto predicts that Bitcoin’s dominance may follow a long-term descending triangle pattern. A descending triangle typically suggests bearish momentum, where the price or dominance gradually decreases as lower highs are formed.

However, this could prolong its market control before a broader correction allows altcoins to gain traction.

Another analyst mentioned that Bitcoin dominance is currently testing the resistance zone between 64% and 64.3%. Therefore, a possible retracement may be on the horizon. Should this retracement occur, altcoins could begin to gain traction, with some potentially emerging as top performers in the market as capital shifts away from Bitcoin.

“However, a breakout from this zone could mean further declines for alts,” the analyst remarked.

Finally, Junaid Dar, CEO of Bitwardinvest, offered a more optimistic view. According to Dar’s analysis, if Bitcoin’s dominance drops below 63.45%, it could trigger a strong upward movement in altcoins. This, he believes, would create an ideal opportunity to profit from altcoin positions.

“For now, alts are stuck. Just a matter of time,” Dar added.

Tether Dominance Signals Potential Altcoin Season

Meanwhile, many analysts believe that the trends in Tether dominance (USDT.D) signal a potential altcoin season. From a technical analysis standpoint, USDT.D has reached a resistance zone and may be due for a correction, suggesting the possibility of capital flowing from USDT into altcoins.

“The USDTD is in a rejection zone, as long as it does not close above 6.75% it will be favorable for the market,” a technical analyst wrote.

Another analyst also stressed that the USDT.D and USD Coin dominance (USDC.D) have reached resistance, forecasting an incoming altcoin season. Doğu Tekinoğlu drew similar conclusions by observing the combined chart of BTC.D, USDT.D, and USDC.D.

As Bitcoin’s dominance climbs, investors are closely monitoring these technical and on-chain signals. The interplay between Bitcoin’s strength and stablecoin dynamics could dictate whether altcoins stage a comeback this summer or face further consolidation. For now, Bitcoin’s grip on the market remains firm.

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.